Articles

Mode W-9 is employed whenever payees have to approve that the number equipped is correct, or whenever payees need approve that they’re perhaps not subject to backup withholding otherwise try exempt out of backup withholding. The fresh Tips for the Requester away from Setting W-9 are a summary of type of payees who are excused of duplicate withholding. 1281, Backup Withholding to possess Lost and you will Wrong Identity/TIN(s). You could potentially afford the balance due found on the employment taxation get back by borrowing or debit cards.

So it added bonus lets the new customers to earn $400 once they put $dos,one hundred thousand into their accounts and then make 20 debit card purchases. Their reimburse will be only be placed directly into a great Us bank or You financial affiliated membership which might be on your individual identity, your wife’s term or one another if it’s a joint account. Just about about three digital refunds might be transferred for the a unmarried financial account or pre-repaid debit card. Taxpayers just who go beyond the new restriction are certain to get an enthusiastic Internal revenue service observe and you can a magazine refund.

You ought to slow down the restrict on the benefits, before taking into consideration any extra benefits, because of the amount triggered each other spouses’ Archer MSAs. Then reduction, the fresh sum limit are broke up just as amongst the spouses if you do not agree on another division. You should reduce the count which may be discussed (in addition to any extra sum) to your HSA because of the number of people sum designed to your own Archer MSA (in addition to company contributions) to your season. Another laws pertains to married couples, chatted about next, in the event the for every spouse provides family members coverage below an HDHP. If you are an eligible person who is actually years 55 or old at the end of their taxation seasons, your sum restrict is actually enhanced from the $step one,100. For example, for those who have thinking-just visibility, you can lead around $5,150 (the newest contribution limitation to have self-only coverage ($4,150) and the a lot more contribution of $step one,000).

Money Exempt Out of FUTA Income tax

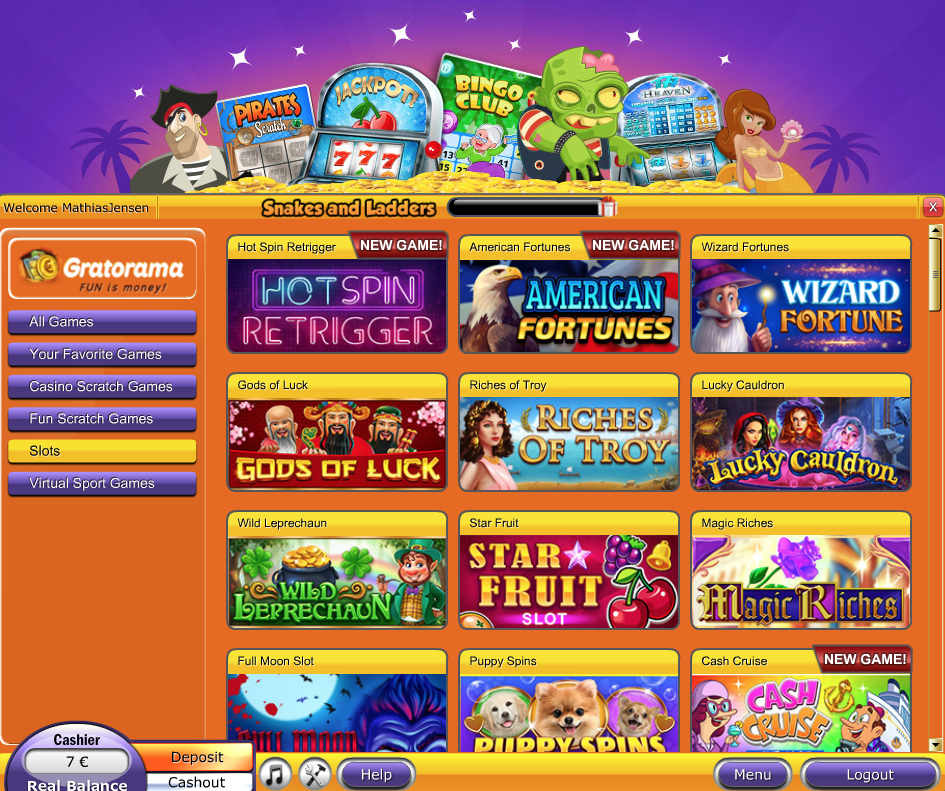

For Cd accounts away from 1 year or quicker, the newest penalty commission try 90 days of interest. Really no deposit incentives are given thus gambling enterprises is excel off their rivals inside increasingly competitive locations. For example, there are a few Michigan casinos on the internet contending for the same consumers, so a no-deposit incentive is a powerful sale unit. Totally free revolves incentives honor you that have spins for the a specific slot otherwise a variety of pokies.

In the event the The Nonexempt FUTA Wages Your Paid back Have been Omitted Out of State Unemployment Taxation . . .

The fresh election and you may commitment of your own borrowing from the bank amount which can be made use of from the employer’s payroll taxation are built to the Function 6765, Borrowing from the bank to possess Expanding Research Items. Any kept borrowing from the bank, just after decreasing the company share away from societal protection taxation as well as the boss show from Medicare income tax, will be carried forward to another quarter. Function 8974 is utilized to choose the amount of the financing which can be used in the current quarter. The total amount from Form 8974, line several, otherwise, when the appropriate, range 17, are said on the Mode 941, Function 943, or Form 944. For more information in regards to the payroll taxation borrowing from the bank, discover Internal revenue service.gov/ResearchPayrollTC. Separate accounting may be needed or even pay more than withheld personnel societal shelter, Medicare, otherwise taxes; deposit necessary taxation; build needed repayments; otherwise document tax returns.

Yearly Get back away from Withheld Government Tax

If your count said on line 5 is actually besides no, utilize this line to incorporate a description to the variance. When the more room is required, mount a layer happy-gambler.com site in order to create 1042 outlining the difference listed on line 5. Extent on line 5 must be the overall said to your range cuatro (total level of You.S. supply FDAP earnings stated for the all of the Variations 1042‐S) reduced the total said on line step three (total You.S. supply FDAP income reportable less than part 4). The full of one’s numbers stated to the contours 63b(1) and you will 63b(2) would be to equal the sum of the all the numbers said inside box 8 of the many Forms 1042-S delivered to users. This is basically the tax responsibility to the period (February 8 thanks to 15) where they made a shipment. This is actually the income tax accountability on the months (April step 1 due to 7) when it supplied the fresh Schedules K-step one (Mode 1065) for the lovers.

To make $300, you ought to deposit at the very least $2,one hundred thousand inside the newest money in this thirty day period and keep that it equilibrium for around 60 days. To earn $five hundred, you should put and keep maintaining at the very least $10,100 inside the new currency. Both for offers, you will need done four qualifying deals — debit credit orders, ACH transmits, wiring, Chase QuickAccept and QuickDepositSM purchases, and you can statement spend — inside 3 months from give registration.

Line 9 will not affect FUTA wages on what you paid zero state jobless income tax only because the state tasked you a tax price of 0%. Go into on the internet 5 the complete of one’s payments across the FUTA salary ft your repaid to each personnel throughout the 2024 once deducting any repayments excused away from FUTA tax revealed on the web cuatro. For individuals who enter a cost on the web 4, look at the appropriate package otherwise boxes on the outlines 4a as a result of 4e to display the types of payments excused out of FUTA taxation. You just declaration a fees while the exempt away from FUTA income tax on the range cuatro for individuals who provided the brand new fee on the web step three.

Monthly fee

The new FDIC—small to the Federal Deposit Insurance Company—try a separate department of one’s United states authorities. The brand new FDIC handles depositors of covered financial institutions located in the Joined States contrary to the loss of their deposits, in the event the an insured lender fails. Your Insured Dumps is actually a thorough malfunction from FDIC put insurance exposure for the most well-known membership possession classes. For those who hop out $ten,one hundred thousand inside the a checking account one to pays 4 percent APY to own annually, you can earn around $eight hundred inside interest. Inside the a classic checking account at the 0.01 % APY, you can earn up to one dollar. Which improvement in the cash rate tends to result in down APYs in your savings account.

- Returns to the Langley Government Borrowing Partnership Certification from Deposits is actually combined and you can credited to your account monthly.

- The new Delaware Section of Taxation has created a keen on the internet site you have access to to check on the newest condition of your own condition refund.

- Once you’ve burned every one of free spins, you could withdraw them immediately after conference the brand new betting conditions.

The brand new Irs reminds taxpayers with not yet recorded their 2021 taxation statements that they can be eligible for a refund if they file and you may claim the new Healing Promotion Borrowing from the bank by April 15, 2025, deadline. Don’t has a offered to discover your own navigation and you can membership count? A routing amount describes the region of one’s lender’s part in which you exposed your account and more than banking institutions checklist their navigation number on the websites. Your bank account amount usually can be located from the finalizing into your online bank account otherwise by the getting in touch with your lender part. See Spend.gov’s service web page to find variations and then make money or get email address to dicuss to spend.gov in person. You’re entitled to claim an excellent 2021 Recovery Rebate Borrowing in your 2021 federal tax come back.

Get in touch with a member of our own group today to find out more about how our very own functions is improve dollars management for your business. Staying away from head put will not prohibit you from all the promotions in which you can make bonus currency by starting a different account. Multiple organizations offer advertisements to users instead of that it requirements, along with HSBC, TD Bank, Pursue, and you may Alliant. At times, sure — particularly if the user is actually better-prepared, understands the fresh words, which is safe dealing with several membership.

Inside 2024, USP, a You.S. relationship, have overseas partners which might be anyone as well as that it features obtained legitimate records to ascertain the foreign position. The brand new withholding tax less than section 1441 relating to the distributive shares of your overseas couples is $120. On the 2024 Mode 1042, USP failed to enter any number as the tax accountability to the contours 1 as a result of 60 because it failed to spread people quantity. A great U.S. branch away from an excellent PFFI that is required in order to report amounts less than part 4 need file an alternative Mode 1042. The degree of tax you are required to keep back decides the brand new volume of your own dumps.

The cash and extra taxation are computed on the Function 8889, Part III. Enter quantities of You.S. origin FDAP earnings not necessary as withheld through to under section 4 to the outlines 2a because of 2d according to the different to withholding one to placed on per commission reportable on the Form 1042-S. The total amount online 2e is always to equal the sum of the lines 2a as a result of 2d. Inability to take action can lead to the new assertion of your refund or borrowing are stated.